A network of digital advocates is seeking an investigation on the safety of Gcash after users reported losing huge amounts stored in their digital wallets.

Digital Pinoys national campaigner Ronald Gustilo said that users of the popular e-money service have reached out to their group after finding their digital wallets emptied after several unauthorized transactions. There were also reports that their Gloan and Gcredit services were used. The heist is also a trending topic in various social media platforms.

“The number of complainants and the amount that was transferred and loaned is alarming. The government should act swiftly and look into this matter immediately as we fear that many more may be victimized.”

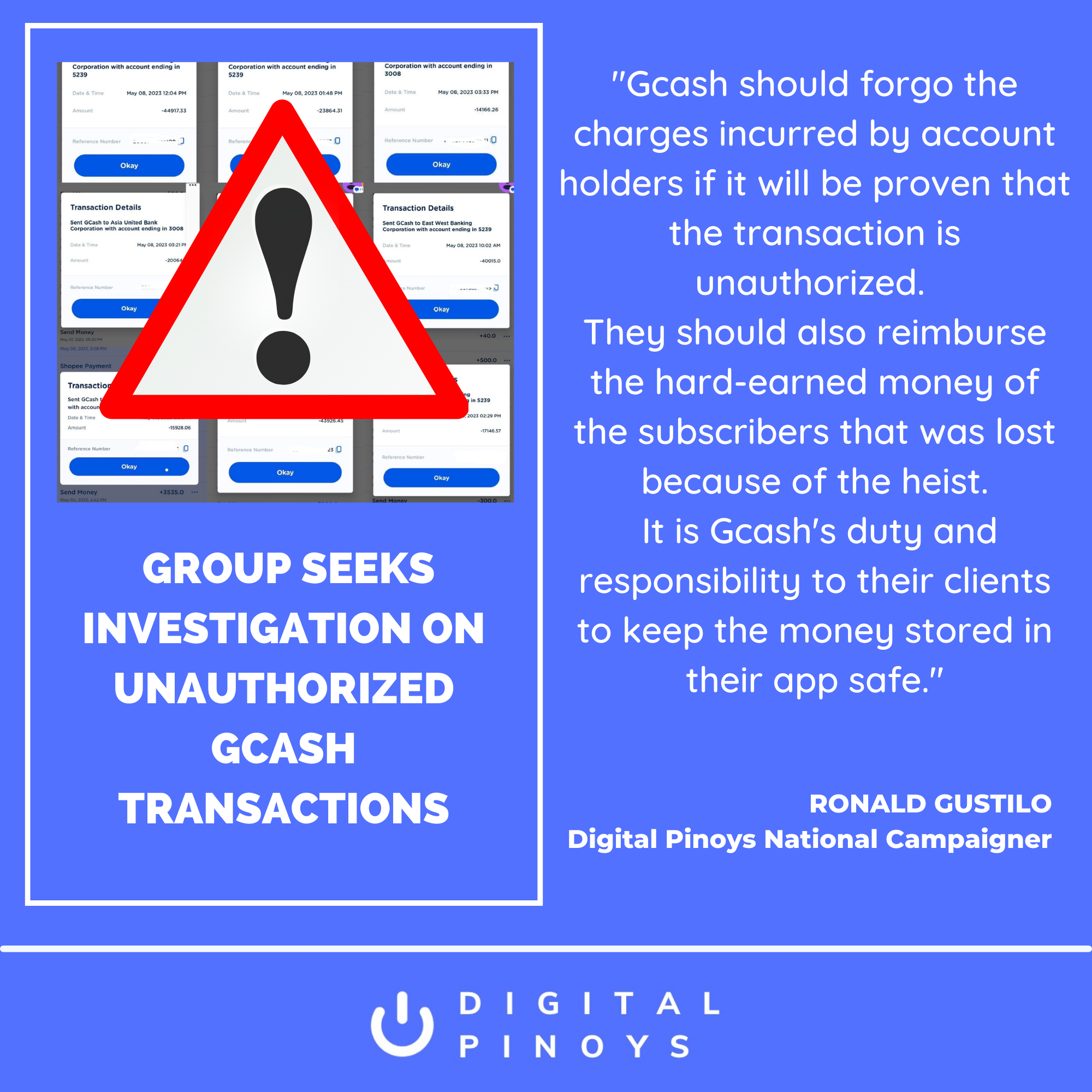

Gustilo said that the victims noticed that most of them had their wallet contents transfered to an Eastwest Bank and an Asia United Bank account. Gustilo is urging the Banko Sentral ng Pilipinas and the management of both banks to investigate the involved accounts.

“BSP, Eastwest Bank and AUB should look into these accounts involved in this massive digital wallet heist and take appropriate actions as soon as possible to delay, if not halt, the operation of the scammers.”

Gustilo stressed that the massive heist committed on their platform should serve as a wakeup call for Gcash to improve the security and verification features of their app.

“We call on Gcash once again. Wake up and do something about your system. Your security features are clearly not enough to protect your clients. This is not the first time that this has happened.”

Reimbursement, loan amnesty sought

Gustilo also urged Gcash to reimburse the victims of the gcash heist and implement a loan amnesty program for subscribers victimized by unathorized transactions.

“Gcash should forgo the charges incurred by account holders if it will be proven that the transaction is unauthorized. They should also reimburse the hard-earned money of the subscribers that was lost because of the heist. It is Gcash’s duty and responsibility to their clients to keep the money stored in their app safe.”